About Hong Kong fictitious asset superintends a law very compendious unscramble

On November 6, 2019, inspect of Hong Kong card meets (SFC) released formally " the warning that concerns contract of fictitious asset futures " and " footing book: Superintend fictitious asset to trade platform " , this is considered as what what inspect of Hong Kong card can release a year before " inspect of Hong Kong card will be fictitious the money superintends a regulation " the follow-up of notional sex frame is compensatory.

On November 6, 2019, inspect of Hong Kong card meets (SFC) released formally " the warning that concerns contract of fictitious asset futures " and " footing book: Superintend fictitious asset to trade platform " , this is considered as what what inspect of Hong Kong card can release a year before " inspect of Hong Kong card will be fictitious the money superintends a regulation " the follow-up of notional sex frame is compensatory.

At that time " inspect of Hong Kong card will be fictitious the money superintends a regulation " basically elaborated the following at 2 o'clock:

Fund is mixed related 1. fictitious money sale platform, can sell to professional investor only, need can be registered in inspect of Hong Kong card;

2. is after feasibility of sandbox experiment test and verify, inspect of Hong Kong card is met or likely to add close money exchange to issue license plate.

And after a year on November 6, 2019, inspect met Hong Kong card make more detailed exposure with respect to the regulation that issued license plate at 2 o'clock, bond is its interpreter colloquialism is:

SFC uses to trade with dealer of broker of the negotiable securities that hold a card and automation the superintendency mark of similar of spatial bid will treat fictitious capital exchange. To accord with this regulation, fictitious capital exchange must be in " custodial asset, KYC, blow washs money and terrorist capital to raise money, the market operates, accountant and audit, risk management, interest conflicts and admit fictitious asset to have business " wait for a respect to accord with superintendency requirement, and accord with the fictitious capital exchange of the requirement will obtain license plate.

And emphasized in statement, "Card inspect is met and have no right to the platform of negotiable securities of blame of buying and selling fictitious asset or token deals or make to its only superintend " . This meaning that is to say, if bourse go up only line like bit money this is planted, be met rule by inspect of Hong Kong card before do not belong to negotiable securities kind fictitious asset, inspect of card of that one Hong Kong can be to do not have administer allow right, because this kind trades to be not accorded with " negotiable securities and futures orders " what set " negotiable securities " or " futures contract " category, accordingly this kind of bourse need not need to obtain license plate to manage.

Actually, singapore of another financial developed country has the place of a lot of likeness, but the to fictitious asset manner of Singapore is being compared with the photograph of Hong Kong under appear more unlock.

The governmental orgnaization that fictitious asset superintends Singapore dominant is Singapore banking management board (MAS) , its are in early June 2016, rolled out " superintendency sandbox " system, aim to provide a favorable system environment for financial company innovation. The company of financial science and technology that this system regulation enlists surely is below the circumstance that signs up for equipment beforehand, allow to be engaged in mixing? The business that legal laws and regulations conflicts somewhat before, although be stopped by the government relevant business, also won't be found out relevant law responsibility. Regulation of this one system gave huge of company of area piece chain innovation space surely.

And on August 1, 2017, MAS was published about first the statement file that token releases case to superintend, statement middle finger goes out " if issue digital money bag contains capital market goods, have capital to invest attribute, for instance can in order to represents ownership, can treat stock or be to collect money investment behavior, the basis " law of negotiable securities futures " get the superintendency of MAS. " those who change character, MAS holds the digital money that does not have investment property, do not suffer MAS to superintend, the superintendency byelaw photograph that dot and this Hong Kong roll out now is similar.

In addition, issue a respect about digital asset, it is not clear that the manner that inspect of Hong Kong card meets still looks at present, but Singapore was released on November 14, 2017 " digital asset is issued how-to " , the digital money that if issue,indicates manages property of some company equity, property on behalf of investor, may change counterpoise for debenture, namely according to " law of authority of negotiable securities period " be superintended.

Though Hong Kong is in of domain of financial science and technology unlock degree not as good as Singapore, but its still attracted the exchange that increases close money field as the financial environment of world finance center and small tax, there are two Hong Kongs that come from a tiny area in the bourse of before at present the world is ranked 10, include bit currency futures to trade Bitmex of first of rank of quantity whole world, and once the biggest bit money over-the-counter trading place, the biggest stable currency USDT issues related side Bitfinex. That one Hong Kong this new does superintendency specification meet the fictitious asset that roll out to to the bourse of these quarter at Hong Kong assorted one is affected?

Regretful is, the basis superintends the specification of byelaw, register more than 10 bourse that are in Hong Kong to take the license plate that is less than SFC to issue at present.

The business of Bitmex is involved " futures contract " trade, according to the view of SFC, "Uptodate the fictitious capital fund that sets business in Hong Kong trades platform has tens of homes, a few worlds' larger platform includes in the center. Partial platform offers contract of fictitious asset futures to trade, and because this kind of agreement is fluctuant flabby reach high lever to change and involve extremely high risk " . According to SFC " stern line of action " , the place of Bitmex sees one spot.

And of Bitfinex trade business involves negotiable securities probably kind of token trade, basis " negotiable securities and futures orders " medium regulation, "If the person that platform battalion carries does central net to hand in easy platform in Hong Kong battalion, be in what at least one kind of negotiable securities token offers on its platform to trade, can belong to card inspect to meet administer Geng is surrounded inside " . Go up in Bitfinex at present of the line trade breed only USD trades to achieving more than kinds nearly 150, among them hard to avoid can have be maintained to be " negotiable securities token " trade breed.

But the problem that Bitmex place faces may be a few bigger, this year the middle ten days of a month when, bitmex made relevant step, began to prohibit last year in its after the negotiant of American IP, begin to prohibit this year again the user of Hong Kong IP.

But say toward good side, after having clear superintendency frame fall to the ground, the Coinbase of Chinese edition is possible from this and be born, be in probably before long day Xuan , we can see China adds up to the rise of compasses bourse.

On November 6 afternoon 5 when make, inspect of Hong Kong card can release " the warning that concerns contract of fictitious asset futures " (the following abbreviation " warning " ) and " footing book: Superintend fictitious asset to trade platform " (the following abbreviation " footing book " ) .

Be in " warning " in, inspect of Hong Kong card can warn the risk of fictitious currency futures directly. Inspect of Hong Kong card can express, the extreme of fictitious asset value below contract of fictitious asset futures is fluctuant, the high lever of contract of fictitious asset futures changes the risk that investor of property Yi Ling faces times add. And the platform of contract of fictitious asset futures involves sale or transaction operate the market and violate compasses activity.

Up to now, card is obtained to inspect can deal or be approbated in Hong Kong without anybody in Hong Kong sale or buying and selling contract of fictitious asset futures.

And be in " footing book " in, inspect of Hong Kong card can elaborate them to trade to fictitious asset in detail the superintendency measure of platform. Involve attestation of asset Yin canal, KYC, market to operate among them, close compasses superintend, doorsill of accountant and audit, professional investor, wash the detailed regulation such as money instead.

In this archives, the superintendency experience that the tradition trades is lent Zuo to arrive in new rule, made clear the orgnaization that hold a card to be able to offer the way of the service to professional investor only.

Hong Kong " big bulletin " columnist, " catenary can schoolroom " senior researcher Fu Rao is accepting academy of new economy of international of column compere, Hong Kong the say when catenary is gotten so that App visits, "Inspect of Hong Kong card sees already can soberly, uptodate trade at the fictitious asset of Hong Kong platform is amounted to tens of, the superintendency demand that they may think card inspect is met is too heavy, aux would rather go managing do not get superintendency business completely. However, card inspect still can act on the point of view that protects investor to set out, published this archives. Published this archives..

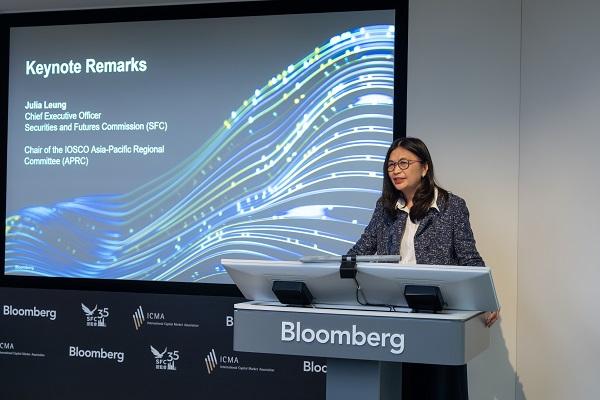

That day (on November 6) on meeting of week of science and technology of Hong Kong finance, inspect of Hong Kong card meets a CEO Oudali is in gist speech say, will undertake to fictitious property industry all-around superintend. In addition, he still emphasizes particularly, "Our regulation is indifferent, the challenge that we face is, how be in the environment of a ten thousand changes in the twinkling of an eye, can carry out good investor to protect a clause, provide useful, detailed guidance to innovation technology. Provide useful, detailed guidance to innovation technology..

Who to superintend?

New rule is applied to carry in Hong Kong battalion and fictitious asset trades in the center of the fictitious asset of buying and selling includes at least one kind of negotiable securities token platform. Inspect of Hong Kong card can express, do not superintend bit money, superintend only trade platform of negotiable securities token; Bit money and other and common add close money, do not belong to negotiable securities.

Inspect of Hong Kong card can make clear, they have no right to the platform of negotiable securities of blame of buying and selling fictitious asset or token sends license plate or make to its only superintend. Because this kind of asset is not belonged to " negotiable securities and futures orders " below " negotiable securities " or " futures contract " . That is to say, offer negotiable securities fictitious asset or token to trade to the client only the platform of the service, the superintendency Geng that just belongs to card inspect to meet is surrounded, although only a kind of token belongs to negotiable securities, also can superintend in card inspect.

How one canal?

A year ago, namely on November 1, 2018. Inspect of Hong Kong card once can release " frame of sex of superintendency idea of digital money exchange " , plan picture hold license plate and do not plan explain the person that the run that gets license plate carries undertakes discriminative treatment.

This year of Xuan , inspect of Hong Kong card can talk for many times with bourse, the business that talks them and superintendency requirement. Took out finally with apply to agency of the negotiable securities that hold a card and automation to trade to superintend mark strictly what mark photograph of the place is like.

Involve appropriate among them the custodial asset, client that knows you (KYC) , blow washs money and terrorist capital to raise money, the market operates, accountant and audit, risk management. Decide only to accord with the platform that anticipates mark to issue license plate.

In Hong Kong card inspect can look, once the platform that chooses to bring into negotiable securities fictitious asset or token Geng of buying and selling to surround obtains hair license plate, investor can distinguish easily get compasses canal and the platform that do not get compasses pipe, this also is the one big characteristic of new superintendency framework.

In addition, inspect of Hong Kong card also can express, although fictitious asset trades,platform obtains card to inspect can send license plate and suffer its to superintend, on this platform the fictitious asset of buying and selling does not suffer apply to sell with traditional pattern " negotiable securities " or " collective invests plan picture " any approbating or compasses of place of the clause of constitution of raise capital by floating shares that register is restricted. Inspect of Hong Kong card is met and set without the other and compulsive exposure that applies to blame negotiable securities fictitious asset to want to make an appointment with.

Inspect of Hong Kong card can point out, although be on the platform that hold a card,the fictitious asset of buying and selling belongs to negotiable securities token, but want this token to make work only only grant professional investor, won't be wanted to approbate form and constitution of raise capital by floating shares to register system place compasses to be restricted about by the investment of Hong Kong.

Notable is, fictitious asset trades once platform operator obtains hair license plate, will be met superintend sandbox by park card inspect inside. This is general imply will need more frequency undertakes closely newspaper, censorial reach postmortem. Superintend through rigor, meeting aux will be able to points out inspect of Hong Kong card mainly quite the Geng that monitoring of interiorly of the person that battalion carries and risk management field should grant to improve farmlands.

Deal reach superintendency detailed rules

If carry in Hong Kong battalion fictitious capital exchange, be in what at least one kind of negotiable securities token offers on its platform to trade, can belong to card inspect to meet administer Geng is surrounded inside, need posses the 1st kind (negotiable securities trades) pass an imperial examination 7 kinds (offer automation to trade service) the license tag that bears compasses canal activity.

The person that inspect of Hong Kong card can stipulate platform battalion carries can offer his to serve to professional investor only, ensure its client knows fictitious asset adequately, still must make bring into criterion strictly to undertake filtration to the fictitious asset of its platform buying and selling.

Specific in light of, individual: $800 10 thousand or the investment combination of above; Law group reachs partnership company: $800 10 thousand or the investment combination of above, or $4, 0 or the total assets of above; The law that believe Yin is round: $4, 0 or the total assets of above.

To bourse, the person that inspect meets Hong Kong card carry requirement platform battalion ensures its a client of 98% is fictitious asset stores line fluctuation purse, and its online on be confined to of fictitious asset bureau does not exceed the client of purse hold 2% . Bourse should quantity decreases from hold the line of fictitious asset leaves major client an asset is dialed to do business in purse.

In bourse insurance keeps frontal field, the person that inspect meets Hong Kong card carry requirement platform battalion ensures place delivers bought insurance hour effective, and the risk that its ensure Geng to surround Ying Han lid to keep with storing on the line fictitious asset place involves means hold client (comprehensive safeguard) , reach the risk that keeps with storing below the line fictitious asset place involves means hold client (majority safeguard, for example 95% ) .

In addition, in dealing condition, inspect of Hong Kong card still can list many add up to rule requirement. For example: When adding relevant service, product newly, need to obtain card inspect to meet beforehand written approval; To card inspect can submit report; Appoint hire the independent major with can acceptability inspect of a card company, the report that weaves relevant law reachs superintendency regulation.

The expert unscrambles: The superintendency of money of word of Hong Kong logarithm, fictitious asset goes in global front row all the time

Although be book of a footing only, but this archives it may be said is All matters, connect the hard bifurcate with fictitious peculiar asset (Hard Fork) or airdrop (Airdrop) also did superintend. Can say, new superintendency orders although the superintendency experience that be born out of trades at the tradition, but be aimed at however " fictitious asset " the form did this one brand-new asset to adaptability is adjusted and be updated, to capital Yin canal, platform trades, safe, wash the respect such as money, KYC to have detailed demand instead. Make this superintendency archives is mixed more strictly it seems that finally change in the round.

Hong Kong " big bulletin " columnist, " catenary can schoolroom " senior researcher pays academy of new economy of international of column compere, Hong Kong Rao Xiang catenary must get App to analyse among them reason:

1, protect investor. Hong Kong is the market that an orgnaization investor gives priority to body. Will ensure platform operation business people the investor that gives major only people, and the person that can prove to those oneself have adequate investment knowledge in this one domain only provides a service. All charter platform must be lost for fictitious asset or be made cast by pilfer protect. Relevant insurance cost may be very high.

2, support open attitude to innovation interest. Fictitious asset has begun to enter traditional money market, great majority also is surrounded to superintendency Geng of existing negotiable securities by classify in. Among them a typical case is bit currency futures, famous bourse of a few United States has begun to offer this kind of product now.

3, care of current situation can. Add close money exchange to already reached tens of homes in Hong Kong increase sharply, so far, these platform do not have the superintendency of any forms greatly. Because most fictitious asset was exceeded " negotiable securities " or " futures contract " legal definition.

He points out, although do not come on stage,card inspect can have known to superintend, a few bourse also have very massive fund investing. To existent big exchange, be once in a blue moon legalization opportunity.

Catenary must get App: What signal did this transmit among them?

Fu Rao: Hong Kong had admitted the means of financing of negotiable securities token secondhand, encourage digital capital exchange and STO (token of negotiable securities fictitious asset) development, count the market dimensions of the dollar.

Involve the reliable and custodial asset, client that knows you, blow to wash money and terrorist capital to raise money, the market operates, conflict of accountant and audit, risk management, interest and the item of main superintendency attention that admit fictitious asset to have business side. Meeting general meets card inspect only to can accord with the platform that anticipates mark to approve a license plate.

The bourse that hold a card must appoint the independent and professional firm that hires inspect of card of a Hong Kong to be able to be accepted, undertake year postmortem to opposing activity of card person exchange and battalion motion, the work out affirms his already comply with dealing condition and all and relevant law and the report of superintendency regulation, hand over inspect of Hong Kong card to meet by time limit.

Above borrows Zuo greatly dealer of negotiable securities broker mixes Hong Kong tradition to trade automatically mark of the system. Also have a few articles at the same time special comfortable the technology that is based on at adding place of close coin industry if " airdrop " , " bifurcate " .

Catenary must get App: To bourse, make relatively adjust, evasive superintend it is some easier to seem?

Fu Rao: Cannot hold Jiao mentality. No less than today (on November 6) another today's issue, battalion carries fictitious asset trades platform may be belonged to break the law. Up to now, without anybody the inspect that obtain evidence can deal or approbate in Hong Kong sale or buying and selling contract of fictitious asset futures. Consider these agreement are uptodate involved risk, to guarantee broad investor, inspect can meet card with respect to what manage concerned contract business approves a license plate or be approbated unlikely.

Be in Hong Kong, any trading if platform or personage allot carry out in the condition that did not obtain proper license plate or recognizes contract of fictitious asset futures or contract of futures of fictitious asset are offerred trade service, all may disobey " negotiable securities and futures orders " (the 571st chapter) or " gamble byelaw " (the 148th chapter) . Disobey " negotiable securities and futures orders " or " gamble byelaw " the personage of concerned article may be accused by check, once conviction, will get criminal punish.

Current, alive bound each district has exchange of a lot of digital currency agreement that add lever. Those who have the objective complete a business transaction that holds a card, be like Bakkt, those who hold a card fry an index, be like CME, more it is not to hold a card (do not suffer superintend) . Also have objective complete a business transaction among them, be like Coinflex, have those who fry an index, be like BitMex. A man of insight already exited Hong Kong market in April this year like BitMex (announce do not accept the investor that comes from Hong Kong) .

Catenary must get App: Whether did this frame offer sense borrowing Zuo for the superintendency plan of most country? How does fictitious assets grow?

Fu Rao: From financial orgnaization amount, finance from amount of total value of asset of dimensions of personnel of course of study, government, IPO, collect of circulation of product of other still banking, illicit registers gross to wait to fund, market of Hong Kong capital is in world front row. Of market of Hong Kong capital superintend also be in world front row.

Leak the information that give according to footing book, this can be only temporarily measure. The rapid development of fictitious asset domain is pressing need is new, comprehensive legislation. That is to say the current situation should force relevant law is made adjust. And the capital market that Hong Kong regards maturity as, of its law laws and regulations edit also have referenced sense to Chinese inland

Origin: Money encircles Bond