Guide language

The appraise with the universally applicable neither one on this world is worth a tool. Resemble nonexistent always motive is same, investing the world, nonexistent any can invite everyone the method of gain money or tool.

When invest, to the enterprise undertaking appraise is worth is an all in all link, and the job that how making accurate appraise be worth is eye of investor of a test.

About appraise value and common appraise are worth a method

Normally cent is method of company estimate cost two kinds: One kind is method of opposite appraise cost, the characteristic is to basically use multiplier method, relatively handy, if P/E appraise is worth appraise of law, P/B to be worth appraise of law, EV/EBITDA,be worth appraise of law, PEG to be worth law, city to sell appraise of sales revenue of standard of the value that lead appraise, EV/ to be worth appraise of law, RNAV to be worth a law; Another kind is method of absolutely appraise cost, the characteristic is to basically be used fold show a method, if dividend discount model, free cash flows a model,wait.

One, the commercial pattern of the enterprise decided appraise is worth mode

- 1.Heavy asset enterprise (if pass all manufacturing industry) , with net assets appraise value kind is given priority to, kind of profit estimate value is complementary.

- 2.Small capital fund enterprise (if serve industry) , with profit estimate value kind is given priority to, kind of value of net assets appraise is complementary.

- 3.Internet enterprise, think for distant view with user number, hits and market share, sell with city rate give priority to.

- 4.Burgeoning industry and high-tech enterprise, think for distant view with market share, sell with city rate give priority to.

2, market prise and company value

No matter use which kind of appraise to be worth a method, market prise is a kind the most effective consult content.

The meaning of ① market prise is not equal at share price

Total share of × of share price of market prise = is counted

Market prise is regarded as market investor is right of company value approbate, side overweight is opposite " volume level " the discretion of absolute value of and rather than. With 10 billion dollar normally market prise regards the quantity of preeminent mature and large company as grade level on the international market, market prise of 50 billion dollar is an internationalization exceeds the level measuring level of large company, and the place with one billion two hundred and fifteen million seven hundred and fifty-two thousand one hundred and ninety-two market prise are indicative paramount enterprise. The meaning of market prise depends on measuring class to compare, absolute value of and rather than.

② market prise is compared

Since market prise reflects the volume level that is an enterprise, the contrast measuring level of congener enterprise has that one very much market sense.

[for example] it is movie and TV is made likewise with release a company, market prise of brother of domestic China friendship 41.9 billion RMB, amount to restrains 6.8 billion dollar, and American dream factory (DWA) market prise 2.5 billion dollar. Additional, income was China friendship brother 2012 1.3 billion RMB (212 million dollar) , income of factory of dream of the corresponding period is 213 million dollar.

The income of these two companies measures class to go up in, and level of market prise volume is not however on a level. Figure from this, china friendship brother is likely by serious overmeasure. Of course, overmeasure value reflected the market to expect a price, overmeasure is underestimated do not form basis of buying and selling, but this is signal of a caution. Astute investor can adopt pair of strong strategy that cover interest.

Common market prise consults quite content:

- With cross market rate of exchange coequally, same home company is compared in the market prise on different market. Be like: AH rate of exchange.

- Rate of exchange of congener enterprise market prise, advocate the company with business basic and same Wu is compared. Be like 31 heavy industry and in couplet heavy division is compared.

- Rate of exchange of market prise of similar business company, advocate business Wu has partial photograph to be the same as, do after fractionation of beard general business congener quite. If Shanghai home is changed,with combination benefit China is compared.

③ company value

Market prise of company value = + be in debt completely

The sense of absolute value reference of EV is not great, it is combined with gain index normally, use report company profit, clean indebted with the relation between market prise. Be like: EBITDA/EV index gains profit with what come to the company that compares close company value ability.

3, appraise is worth a method

① market prise / net assets (P/B) , city is led completely

Inspect net assets to must have the project that does not have great turnover forms for reporting statistics clearly. Net assets should do eliminate processing, in order to reflect the structure of management sex capital with real company. City leads the ability in wanting to be being compared completely significant, absolute value is insignificant.

Find out an enterprise to be in quite long time paragraph the historical lowest inside, highest peace all 3 archives city leads interval completely. Inspect cycle at least 5 years or a whole economy is periodic. If new appear on the market enterprise, must have at least 3 years trade the history.

Find out course of study of person of the same trade to have longer trade historical enterprise makes contrast, make clear 3 archives city to lead interval completely

② market prise / net profit (P/E) , city is filled with rate

Inspect net profit to must have the project that does not have great turnover forms for reporting statistics clearly. Net profit should do eliminate to handle, in order to reflect the net gain with real company. City is filled with rate the ability in wanting to be being compared is significant, absolute value is insignificant.

Find out an enterprise to be in quite long time paragraph the historical lowest inside is highest peace all 3 archives city is filled with rate interval. Inspect cycle at least 5 years or a whole economy is periodic. If new appear on the market enterprise, must have at least 3 years trade the history.

Find out course of study of person of the same trade to have longer trade historical enterprise makes contrast, make clear 3 archives city to be filled with rate interval

③ market prise / sale (P/S) , city is sold rate

Sale must be made clear its advocate battalion is formed, have the project that does not have great turnover forms for reporting statistics. Find out an enterprise to be in quite long time paragraph the historical lowest inside is highest peace all 3 archives city sells rate interval. Inspect cycle at least 5 years or a whole economy is periodic. If new appear on the market enterprise, must have at least 3 years trade the history.

Find out course of study of person of the same trade to have longer trade historical enterprise makes contrast, make clear 3 archives city to sell rate interval.

④ PEG, reflective city is filled with the ratio between rate and net profit increase rate to concern

PEG= city is filled with rate / net profit increase rate

Think normally, this ratio =1 states appraise value is reasonable, ratio > overmeasure of a specification, ratio <1 specification is underestimated. This kind of method serves as city to be filled with the auxiliary index of rate only in investing practice, actual combat sense is not great.

⑤ Benjamin Geleiemu grows an appraise value is formulary

Value = year accrual × (8.5+ anticipate year of increase rate × 2)

Year of accrual in formula for recently accrual of a year, can use every accrual TTM (recently the accrual of 12 months) replace, expect year of increase rate that increase rate is future 3 years. Suppose, every accrual TTM is some enterprise 0.3, the increase rate that expects future 3 years is 15% , criterion =0.3* of company share price (8.5+15*2) =11.55 yuan. This formula has stronger actual combat value, computational result beard and index of other appraise cost are united in wedlock, cannot use alone.

Above means all cannot be used alone, should cooperate two kinds of combination to grind at least sentence, its absolute value also does not have actual combat meaning. The key that appraise is worth is to compare, especially the comparison of similar company, cross a trade also no point.

Appraise is worth 3 when go up small errors

An investor needs to learn two homeworks only actually: How to understand the market and how appraise value.

, Buffett

Those think company value is equal to a few simple financial ratio, be equal to simple PE, PB, plus the person of transverse and fore-and-aft contrast, don't you feel you are too babyish?

If this one determines company value easily, the person that a this high school graduates can be opposite Na Yaoji all enterprises undertake appraise is worth. A meeting checks a data to meet comparative person, with respect to can simple contrast a few numbers obtain money of a huge sum.

In the world of this dogfight, can examine a data, the meeting is comparative a few financial data, not be competitive advantage, also not be real appraise value.

Value investment has 4 basic ideas and two important hypothesis.

- 1. stock is equal to equity, it is company ownership.

- 2. is used " market gentleman " will be opposite come the wave motion of the market

- 3. because future is insensible, need safe limit so

- One individual course learns 4. for long, the ability that can form oneself is encircled

These 4 concepts are the core idea that valence drops above, two important hypothesis are below.

Suppose 1: The price can draw close to value

Basically, in the US stock, the time that the price draws close to value is 2-4 year. Also be to say namely, if you found a correct bargain really, spent 5 wool money to buy the thing of a money.

In the US stock, money of this 5 wool goes afresh the time that returns a money is 2-4 year.

If be 2 years of regression, that one year turning profit is 41% .

If be 3 years of regression, that one year turning profit is 26% .

If be 4 years of regression, that one year turning profit is 19% .

If send price,always form a word actually, that one this with respect to the word namely: Spend 5 wool money to buy the thing of a money, ensure money of this 5 wool can be in next 2-4 becomes a fund inside year (activator) .

The reason that the price can draw close to value has a lot of, e.g. 2-4 year be when letting other very much investor also discover this is a good investment opportunity, but its most important basis is: Regression all is worth and count theorem greatly.

Suppose 2: Value is measureable (Measureable)

Will tell to investor, value is measureable have two meanings:

- A. Value itself is to be able to pass a few clew to be detected to come out. Value Is Measureable

- B. You can detect come out value. Value Is Measureable BY YOU.

So called finance affairs is analysed, industry analysis, it is the value that using clew to locate a company substantially. And a lot of people take the branch for the root however, believe 9 analysises tool blindly. The appraise that a few summary introduce below is worth the small error that go up.

Error 1: Spread free ready money the model is changed

The definition of company value is particularly simple: The value of the enterprise is equal to an enterprise to be in what the free cash of gain of prospective time internal energy flows to lose present worth. But notable is, this definition can deal in generalities, cannot the model is changed.

10 each fold there are 9 at least in the model now is talk nonsense by cash shedding.

The reason is very simple: Almost cash shedding loses all freedom show a model to need to forecast 3-5 year free cash of future flows, appearing next one " stop a value " (Terminal Value) .

Above all, unless you are forecasted, is Coke Cola, american carry tells this kind of company, forecast 3-5 otherwise year financial data is done namely simply laugh, accuracy is very low.

Additional, below great majority circumstance, free cash flows fold show the termination in the model to be worth the 50% above that held value of the stock in the model. Accordingly, want to stop change of value happening little only, whole appraise is worth may poor a great distance. And this stops a value 50% discount lead now very sensitive, will fold lead now reduce 1% , the appraise cost of whole company may rise 1 times.

Cannot the model is changed do not represent this notion cannot in actual life is used, you are only cannot use free cash simply to flow fold show a model direct calculation appraise is worth just. But you can use this model to undertake converse thinking, push instead it is tall that appraise is worth a level now it is low.

Cite a case:

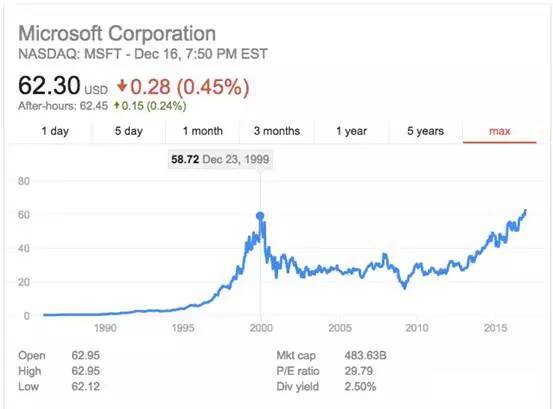

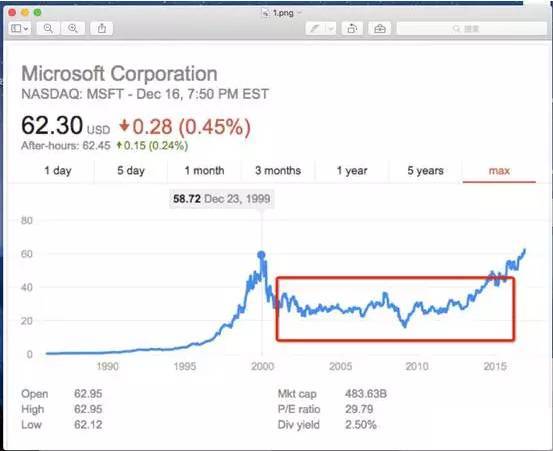

1999 when Internet bubble, the share price of Microsoft is top arrived left and right sides of 59 U.S. dollors, the corresponding PE at that time is 70 times, in those days every dividend profit is left and right sides of 0.86 U.S. dollors. Do this mean assorted one?

Will explain one issueing assorted simply first is free cash flow: Free cash flows is to show an enterprise was being satisfied short-term live pressure and live for a long time the can control freely cash reserve in a bank after pressure flows.

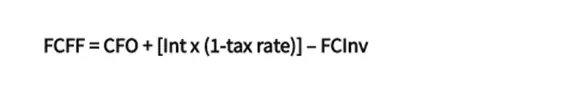

If want to use formulary expression, treat the enterprise as a whole, free cash flows be equal to:

Among them what CFO points to is to manage sexual cash to flow, what FCInv points to is fixed capital expenditure, what Int points to is interest expense.

In returning the case above afresh:

There is 50% in the profit of this 0.86 U.S. dollors suppose is free cash flows, remain 50% be must capital spending. That one is in the free cash of Microsoft flowed 1999 is 0.43 U.S. dollors. Next, our hypothesis Microsoft is added in what did not come 10 years fast be 30% , successive to any enterprises 10 years of 30% add fast had been flying God add fast.

That one is in 2009 when, its in those days free cash flows is 5.93 U.S. dollors, 13.8 times was 1999.

Next, when 1999, american interest rate is 5%-6% , because this is in,fold uptodate, we are used 10% . Next, we can spread the ready money that all predicting go to from 2000 between 2010 computation comes out, it is respectively: 0.56, 0.73, 0.94, 1.23, 1.6, 2.08, 2.7, 3.51, 4.56, 5.93.

Next will above free cash flows according to of 10% fold lead now fold come back now, we can get an astonishing number: 12.1 U.S. dollors.

That is to say, 1999 Microsoft share price arrives at 59 U.S. dollors that day, the free cash that did not come 10 years flows those who folded present worth to hold share price only merely 20.5% (12.1/59) .

In other words, microsoft gives 59 dollars one day that in the market, after there is 80% to depend on 10 years in the value of Microsoft share price, namely after 2010, the outstanding achievement of Microsoft is behaved, cash shedding gains the freedom of Microsoft fast.

Actual share price performance explained everything. Microsoft from 2000 later, share price is maintained all the time in 20-30 U.S. dollor, found new business engine till it, cloud computation.

The example above is to explain only a bit: Free cash flows fold now, it is means of a kind of thinking, not be computational formula, cannot simple model is changed (DCF model) .

Error 2: Simple use PE is worth index as appraise

Below great majority circumstance, the PE that great majority person uses is useless index. I once listened to counterjumper in inn of a duplicate asking someone else the question, I see in Xxx software business, bank PE is very low, can you buy?

If you are returned today,mix in simple absoluteness use PE PB, you basically are equivalent to investing the passerby armour in the bound, common says " leek " . PE and PB index are like next problems:

There is hard injury on ① thinking level

Is assorted one called thinking level to there is hard injury? That is to say, this index has hard injury in formulary level.

PE= share price / every gain

If you fluctuate formula to be multiplied at the same time with total capital stock, total market prise of that one PE= / net profit; So, when you use PE, it is to pondering over the relation between total market prise and net gain substantially. This also is meant, PE is pondering over the level to go up to have hard injury.

Because, the value cent of an enterprise is two parts: Shareholder value (market prise) with loan value (indebted) . PE considered shareholder value only merely, did not consider any loan value.

Cite the case of an extreme, the market prise of hypothesis enterprise A is 100 million U.S. dollor, the profit before annual tax is 100 million U.S. dollor, net profit is 60 million U.S. dollor, be in debt is 9.9 billion U.S. dollor.

Although PE is 1.67 times, but because be in debt too serious, but if you regard a whole as creditor and partner, this company value 10 billion U.S. dollor (the share of the debt that buys loan at the same time and partner) , actually " PE " it is 166.7 times.

② EPS makes a holiday very easily

PE this index the 2nd big question is, EPS makes a holiday very easily, put easily in a lot of one-time gain.

PE this target is real the means that considers expression: When I should buy a company, I pay how many multiple for its present profit.

But apparent most person uses a fault. Because the problem that creates a holiday exists likely in present profit, put in one-time gain at the same time. Actually, this " present profit " specific should be worth is " appear now, and also appear later management sex profit " .

Accordingly, if want to use PE, most at least should undertake moving Zhang, manage all blame quality, the profit that cannot last completely take out, get a profit that management sex can last.

If you are when use PE, the gain ability that can last of the consideration is an enterprise (Normalized Earning Power) , this became that one rate of a practicable. This is the complex part of investment, also be interesting place.

③ low PE is not represented underestimate a cost

It is wrong that the market does not represent the market to low PE of a company. The profit that because possible market is in,predicts company future is very poor. E.g. a company present share price is 10 U.S. dollors, EPS is PE of 10 U.S. dollors be 1, look be like very low.

But, perhaps the market thinks to there are 8 U.S. dollors in this 10 U.S. dollors is one-time gain, or the market thinks the gain ability of the enterprise is worsening, this year gain 10 U.S. dollors, next year the likelihood has 1 U.S. dollor only.

If the market is right, that one now although PE looks be like is 1, but also do not represent firm petty gain.

Below this kind of circumstance, if you want to invest this stock, the logic that you want to know the market is assorted one, and market of the one that it is assorted is a fault.

Error 3: Simple use PB is worth index as appraise

PB index is used in finance and insurance industry is a first-rate index, because the asset in these company hands is most,cash is below the circumstance. Because this may represent a rate that the company is underestimated. Take PB to measure American bank if, it is an effective index.

Nevertheless I think, measure a bank the mainest index is not PB, the ROA after be being adjusted however.

This index thinks PB true means of expression: See present share price take a company " net assets " how many. If share price under net assets, "Theoretic " the company is " safe " .

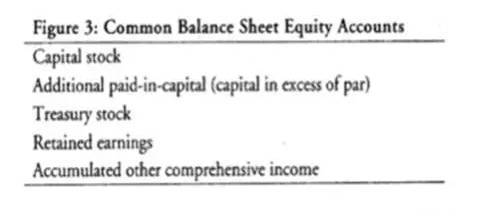

That one issue came, is great majority person how to be calculated " net assets " ? They used Book Value directly, from formula, the capital fund of = of BookValue= possessory rights and interests that most person uses - indebted.

If you are of PB of this one computation, that one PB is an useless index. Because manage the behavior of the layer to be able to affect the size of possessory rights and interests directly,this basically is.

In GAAP money newspaper, possessory right has 4 content:

Final Accumulated Othercomprehensive Income (other and integrated income, OCI) , in accounting standard of the United States, write down this OCI in profit the outside and the inside commonly, so here did not introduce more.

The biggest question of possessory rights and interests goes in inventory go up with keep accrual. Appear on the market the company is after the stock that counter-purchased his, record these shares for inventory.

These inventory it is possessory rights and interests in decrease. That is to say, this one is negative.

Accordingly, counter-purchase more stock when a company, cause stock become much, accordingly possessory rights and interests should subtract one compares large number, so decrescent of possessory rights and interests.

The possessory rights and interests that this is assorted one IBM namely such small, ROE such tall. Because IBM is arrogant,not be, counter-purchased much stock because of IBM however!

You can see, when a company scale of share out bonus is jumped over big, its keep profit is smaller, possessory rights and interests is minorrer, ROE is bigger. When a company rate of share out bonus is jumped over small, its keep profit is bigger, possessory rights and interests is larger, PB is bigger.

Accordingly, in great majority moment, I do not use PB, need not use ROE, do not undertake Du Bang is analysed. Namely because I am right these formula are very familiar, so I am in only minority uses them when they are effective.

If correct appraise is worth?

What should say above all is, the appraise with the universally applicable neither one on this world is worth a tool.

Resemble nonexistent always motive is same, investing the world, nonexistent any can invite everyone the method of gain money or tool.

Accordingly, basically the appraise cost method with every the most accurate industry is different also. This should establish this ability group for assorted one namely. Be in for instance energy industry, the oil of replacement cost and enterprise or natural gas reserve is very good appraise cost method.

Although we do not have an all-purpose key, but it is apparently good to have still a few appraises are worth a tool at PE and PB.

One, EV/EBIT

Actually, the appraise that EV/EBIT is PE of an apparent excel is worth a tool. The market prise that PE is equal to an enterprise actually is divided with net profit. And the one part that market prise just is an enterprise just.

EV/EBIT solved this problem. What EV points to is company value, company value considered shareholder not just, still considered loan.

Accordingly, market prise of company value = + be in debt for a long time + rights and interests of a few shareholder - cash. This is treat the enterprise as wait for in light of a whole, avoided the problem of PE thereby.

Additional, because PE did not consider capital structure, so a lot of moment even if two companies that are in same industry also cannot contrast possibly directly. And EBIT is the profit before interest duty, eliminate drops the capital structure influence to company profit, have more thereby can compare a gender.

2, replacement cost (Replacement Cost)

What replacement cost points to is now now mix newly at present the enterprise is produced can, the enterprise like efficiency needs the cost of expenditure. This just is true actually " PB " .

To science and technology will tell, this one cost is adjacent at imponderable, but to the sources of energy, capital construction, retail wait for a company to tell, replacement cost has important sense.

Assume there are existing 100 competitors in the market today. Next a shrewd businessman wants to enter this market, he has two plan commonly:

- Him 1. builds a business, compete with these 100 adversary.

- 2. buys a company from enterprise of these 100 competition, enter this market.

Below circumstance of one of that one assorted, use plan 1, is program used below assorted one circumstance 2? Actually very simple: When at present the market prise of the enterprise in the market is less than replacement cost, shrewd businessman can choose to buy. When at present the market prise of the enterprise in the market is more than replacement cost, the businessman can choose him to build a business.

From the point of industry point of view, if an industry is in periodic when underestimating, integral value was less than its replacement cost, this means this industry to have new entrant very hard again.

In refinery industry, a refinery is to buy expensive one of index of the most important core with still buy cheap are: Replacement cost. The replacement cost of a refinery, tore open this refinery namely actually, rebuild exactly like the expenditure that need pays.

Build devoir to be again commonly: Greenbelt rebuilds cost (GreenfieldReplacement Cost) with pollution the ground rebuilds cost (Brownfield Replacement Cost) .

Greenbelt builds again is to point to the cost that builds equipment again on the land that had not polluted originally. General greenbelt builds this meeting to have high environmental protection cost again. Polluting the ground to build what point to originally again is the cost that weighs construction equipment in the place that has produced pollution.

Company value is equal to his to did not come to what free cash can arise to flow inside time to lose present worth. This definition is adjacent at perfect. But this is sure to keep in mind a definition to be changed without method model almost, basically the DCF model of 95% is talk nonsense.

You issue all one's life to also won't see Li Jiacheng, wang Jianli, buffett, when judging a company to be worth how many money, ask two experts to do two each to be folded by cash shedding show a model to look.

When they are judging an enterprise to be worth how many money, nothing more than consider 3 things:

- The assets with this current business is worth 1. how many.

- 2. now how much is the normalization profit of the enterprise? I come the word of operation can cut those cost, profit of how many normalization can you increase?

- How many does the growing sex of 3. enterprise still have?

PB is to solve the first problem to miss the target of creation substantially. The asset value that gives a company for truer reflection how many money, you may need to browse carefully balance sheet, need examines the likelihood to build this waiting <> a moment again.

PE is to solve the index that the 2nd problem thinks out substantially, but like be the same as PB, this index also was abused. Some appear on the market the one-time gain with the many existence in the company, many blame manages sexual gain, want to buy this company thoroughly really when you, you can consider the normalization profit that can last only.